Synthesis & Cintra: Your Partners for Oracle on AWS Success in South Africa

Synthesis Staff

- AWS, Cintra, Cloud, oracle

We have crafted solutions for industry leaders, combining years of expertise with agility and innovation.

Financial institutions are mandated to be compliant but what happens when the volume of data makes this impossible?

This was the challenge facing a top South African bank that not only wanted to be compliant but to discover insights and improvements from its customer data.

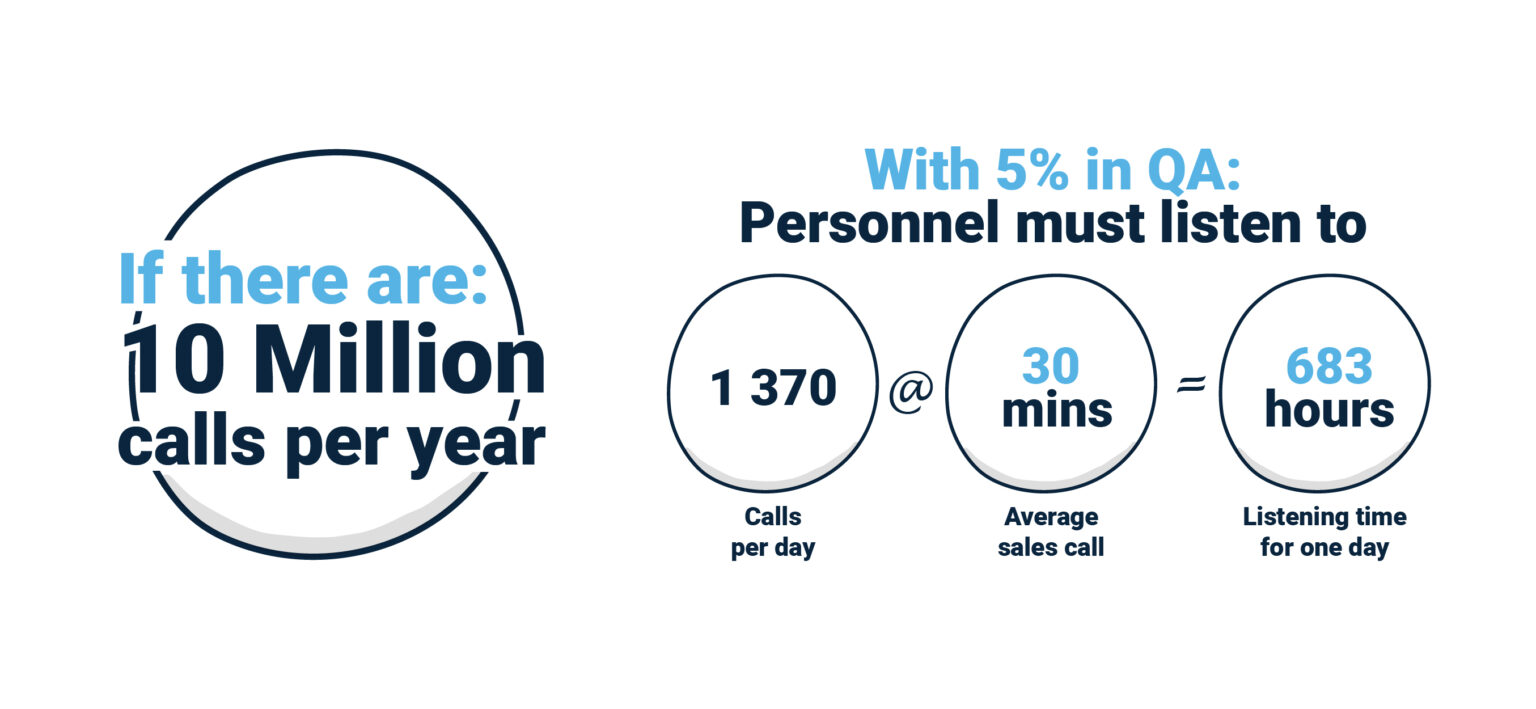

Regulators require at least 5% of all calls to go through quality assurance (QA). The bank, like many large organisations, was receiving 10 million calls per year which it was manually checking.

With approximately 1 370 calls a day at an average of 30 minutes per call, employees would need 683 hours of listening time for one day’s worth of calls.

This made compliance impossible. Being unable to QA calls was becoming risky business with the threat of penalties and fines if the bank was found to be non-compliant with AML/FAIS/TCF/NCA/POPI etc.

The reality of being inundated with these volumes of calls to process was that the bank was able to only listen to 1% of calls, while still having to foot a bill of R11m p.a. for a team of QA officers – above and beyond the fines.

The bank was also at risk for external fraud if customer authentication was not performed correctly and this manual process opened the bank up to unchecked human error.

Lastly, and most significantly, the bank was missing out on customer conversations that could offer a world of insight. It also missed the opportunity to check its customer service which could lead to poor customer treatment and a loss of revenue.

The bank would need to leave manual processing behind if it wanted to be compliant, satisfy customers and scale while cutting costs

The bank consulted Synthesis Software Technologies, a software development company known for developing innovative solutions, to see if it could help with the impossible.

“Interactions with clients happen. Isn’t it time that companies not only adhere to regulatory requirements, but derive value from them? That is what we did for our customer,” explains Synthesis Hugo Loubser.

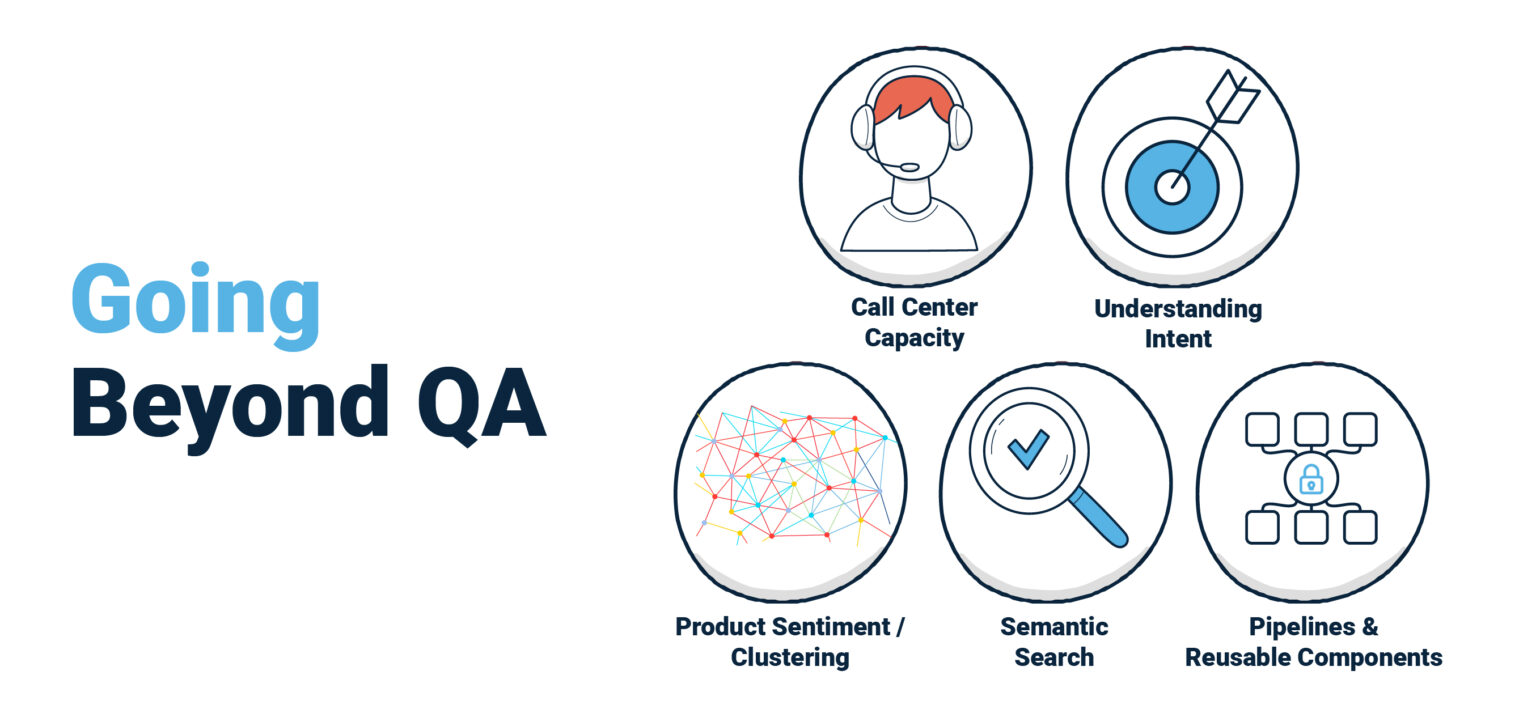

Synthesis built an automated quality assurance system, capable of parsing large amounts of conversation or verbiage to determine whether or not agents were being compliant.

To make this possible, cutting-edge technology from the fields of Automatic Speech Recognition and Natural Language Processing (NLP) were employed using cloud engineering expertise to wrap it all up into a scalable and robust solution.

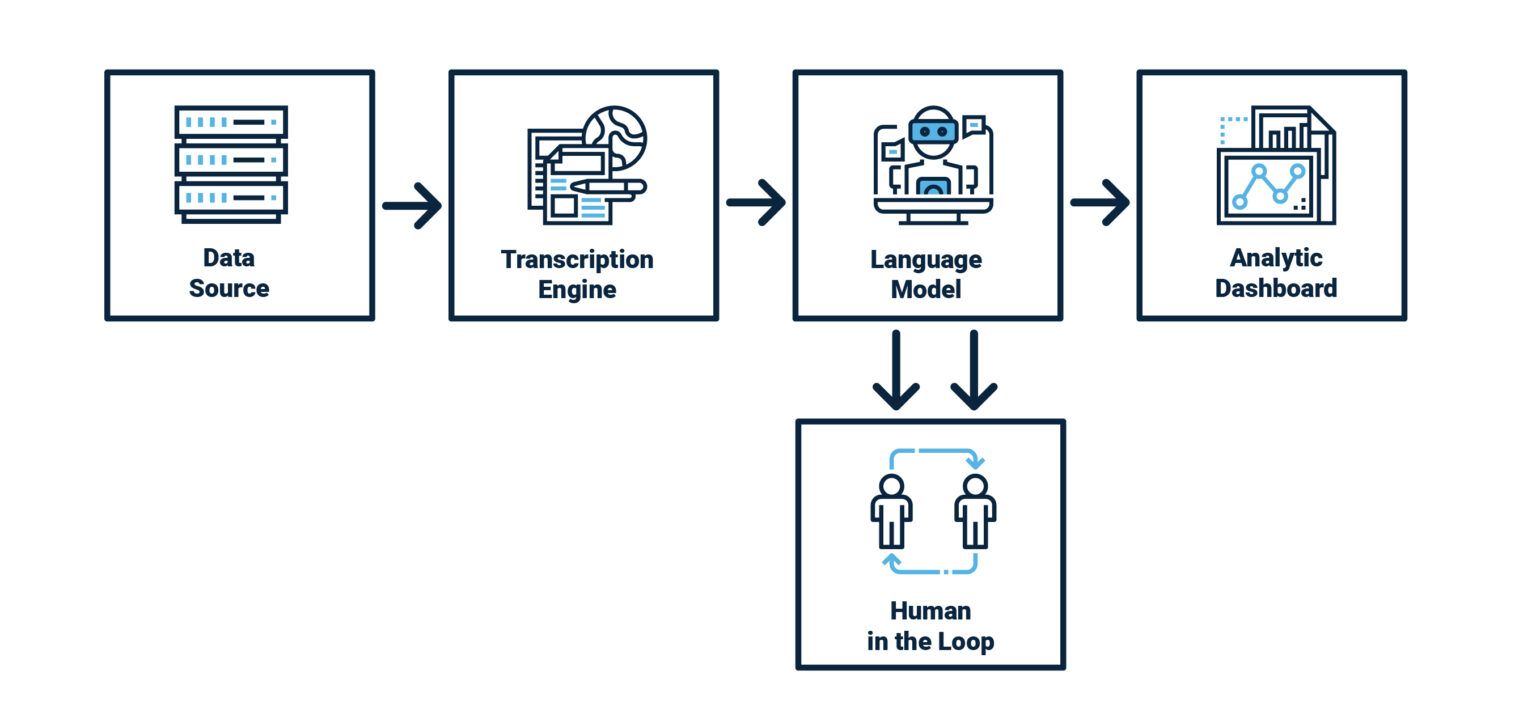

Data Source

The minimum requirement for this solution to work is a set of recordings from a contact centre platform, like Amazon Connect. When using a service like Amazon Connect, however, these recordings are coupled with metadata that drastically enrich the depth and breadth of the insights produced by our solution.

Transcription Engine

The recordings are then fed into a speech-to-text model that transcribes the audio to text. This is done to get the conversations into a format that Synthesis’ Language Model expects and to allow its redaction algorithms to mask any Personally Identifiable Information – as QA often needs to be done in heavily regulated domains.

Language Model

In this component, Synthesis e Natural Language Understanding (NLU) model – based on the famous Transformer architecture, interprets the language in the conversations to identify whether or not agents were compliant. It’s here where Synthesis applies business rules to the model output, to make seemingly random numbers generate immense business value.

Human The Loop (HITL)

The HITL components ensures that the NLU model’s performance continuously improves, as well as providing business stakeholders with an honest assessment of how well the model is performing.

Analytics Dashboard

Finally, model output coupled with CRM data is aggregated and visualised on an analytics dashboard for technical and non-technical stakeholders alike to ingest and derive value from.

The bank now has an automated system that surpassed what it thought possible. It can now process call volumes at scale with a 98% accuracy.

Instead of using hours of hundreds of employees’ time, now the system only needs one person to check that the model’s performance does not deteriorate over time and that business has an updated view of compliance daily.

The bank is not only compliant, but it has entered its customers’ conversations in a meaningful way. “This solution can start driving retention and marketing campaigns using data directly from the mouths of your clients,” says Loubser.

Its call centre is alleviated and the bank is ready for possibilities beyond the QA.

Ends

For more information on the innovative work Synthesis has done for its clients, contact us on 087 654 3300

About Synthesis

Synthesis uses innovative technology solutions to provide businesses with a competitive edge today. Synthesis focuses on banking and financial institutions, retail, healthcare and telecommunications sectors in South Africa and other emerging markets.

In 2017 Capital Appreciation Limited, a JSE-listed Fintech company, acquired 100 percent of Synthesis. Following the acquisition, Synthesis remains an independent operating entity within the Capital Appreciation Group providing Cloud, Digital, Payments and RegTech services as well as corporate learning solutions through the Synthesis Academy.

Copyright © 2024 Synthesis. All Rights Reserved. Sitemap

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields