Creating Payment Ecosystem Awareness – Moving the Economy from Cash to Digital

Helesha Moodley

- Banking, payments

We have crafted solutions for industry leaders, combining years of expertise with agility and innovation.

Banks face the onerous task of compliance reporting. They need to continuously stay up to date with changing SARB requirements. When banks are not compliant with these requirements, heavy fines and reputational risks result. Al Baraka Bank, a world leader in Islamic banking, priotitise meeting SARB requirements. The bank recently modernised its core banking platform and consulted Synthesis to integrate this new system with the SARB through txstream which resulted in a streamlined reporting solution.

Banks need to ensure that the correct information is submitted based on SARB requirements. This includes Balance of Payments (BoP) reporting on foreign currency trades to the South African Reserve Bank (SARB) in a specified format to comply with Financial Surveillance requirements. When Al Baraka began updating its core banking platform it needed to ensure that the new system integrated with SARB and complied with local legislation. The previous system that managed cross-border payments was run in-house by the Al Baraka development team. This system was time and maintenance heavy.

A streamlined and outsourced solution would ensure that the new platform correctly integrated and maintained SARB standards. Al Baraka contacted Synthesis to manage this integration as the software development, digital solutions and regtech company is at the forefront of SARB reporting with 18 years’ experience serving the majority of South African Banks.

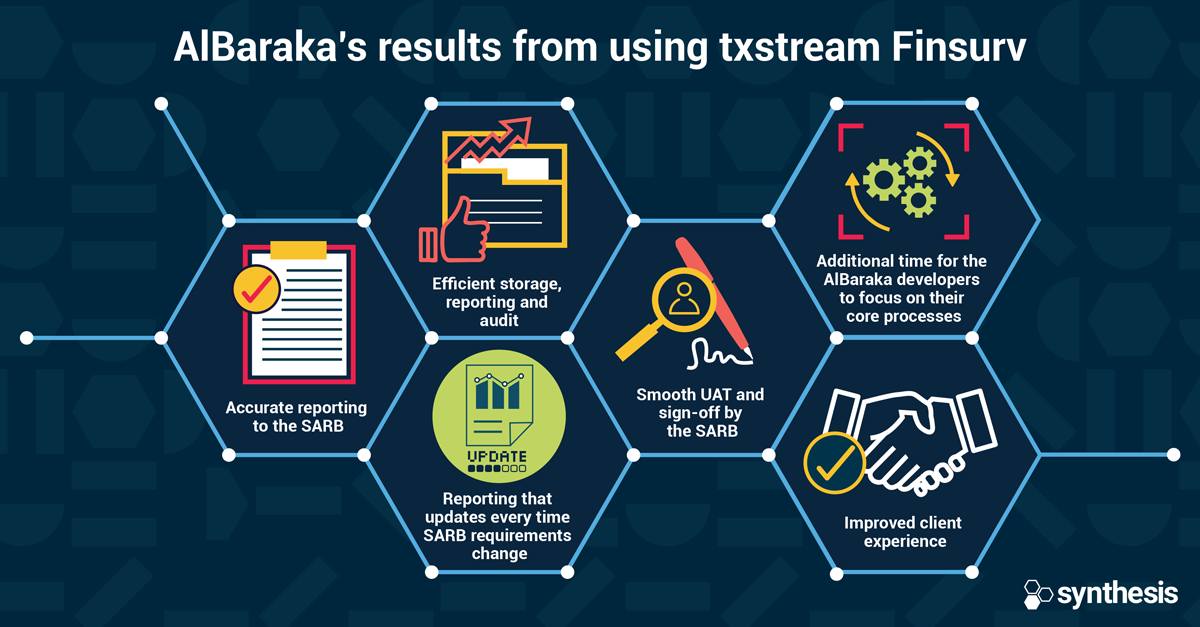

Synthesis implemented its balance of payments and txstream solution into Al Baraka’s core platform. This enabled Al Baraka to accurately report on all transactions to the SARB, simplify its deployment of consistent FinSurv rules throughout the bank and provide an application that allows for efficient storage, reporting and audit. Synthesis’ Chris Assad explains, “We simplify the payments process and regulatory reporting requirements, resulting in better overall compliance to the SARB rules.” The rules-based approach of the solution validates the information against SARB rules to ensure all the correct information is provided. This ensures accuracy and speed.

Assad says, “SARB reporting has onerous validation requirements. txstream incorporates a feature that expedites this. The system applies validation and alerts users if anything is missing. We expose the validation rules via a web service so the bank’s internal system can leverage off it. Also, our software takes care of the complex re-submission process. To re-submit, one needs to delete the previous transaction and flag the new one. txstream takes care of the complexity of cancelling, waiting for a response and then resubmitting. In other systems, this all has to be done manually.” Al Baraka’s Chief Operating Officer, Mohammed Kaka, describes working with Synthesis, “The team were open, frank and clear in their capabilities and delivered timeously. They worked hard to ensure very tight deadlines were achieved and delivered a solution that is robust and simple to use.”

Outsourcing this solution resulted in additional time for the Al Baraka developers to focus on their core processes and capabilities, such as creating value-adding additions to the banking platform and client experience. txstream removed the burden and time involved in regulation updates and SARB communication. “Compliance is held very high in Al Baraka’s priorities. By implementing the txstream fully-automated system, Al Baraka benefits from daily reporting that updates every time SARB requirements change,” says Assad.

Kaka concludes, “We were impressed by Synthesis’ technical compliance to South African Exchange Control Regulations which was built into the system and txstream’s ability to connect with the new core banking solution. Staff have experienced improved efficiencies from this and overall this element resulted in a smooth UAT and sign-off by the SARB.” The client experience also improved as Al Baraka had updated forms and were able to get all the information from clients without additional calls and queries. This resulted in a smoother and faster process which is a priority to Al Baraka. Kaka concludes, “I would recommend Synthesis and txtream. The team and solution are definitely fit for purpose.” To learn more contact us.

Copyright © 2024 Synthesis. All Rights Reserved. Sitemap

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields