Creating Payment Ecosystem Awareness – Moving the Economy from Cash to Digital

Helesha Moodley

- Banking, payments

We have crafted solutions for industry leaders, combining years of expertise with agility and innovation.

Synthesis was approached by one of the South African Banks to assess the impact of PayShap on their existing payment landscape to participate in this industry-led initiative.

It is the industry’s digital payment alternative to physical cash payments.

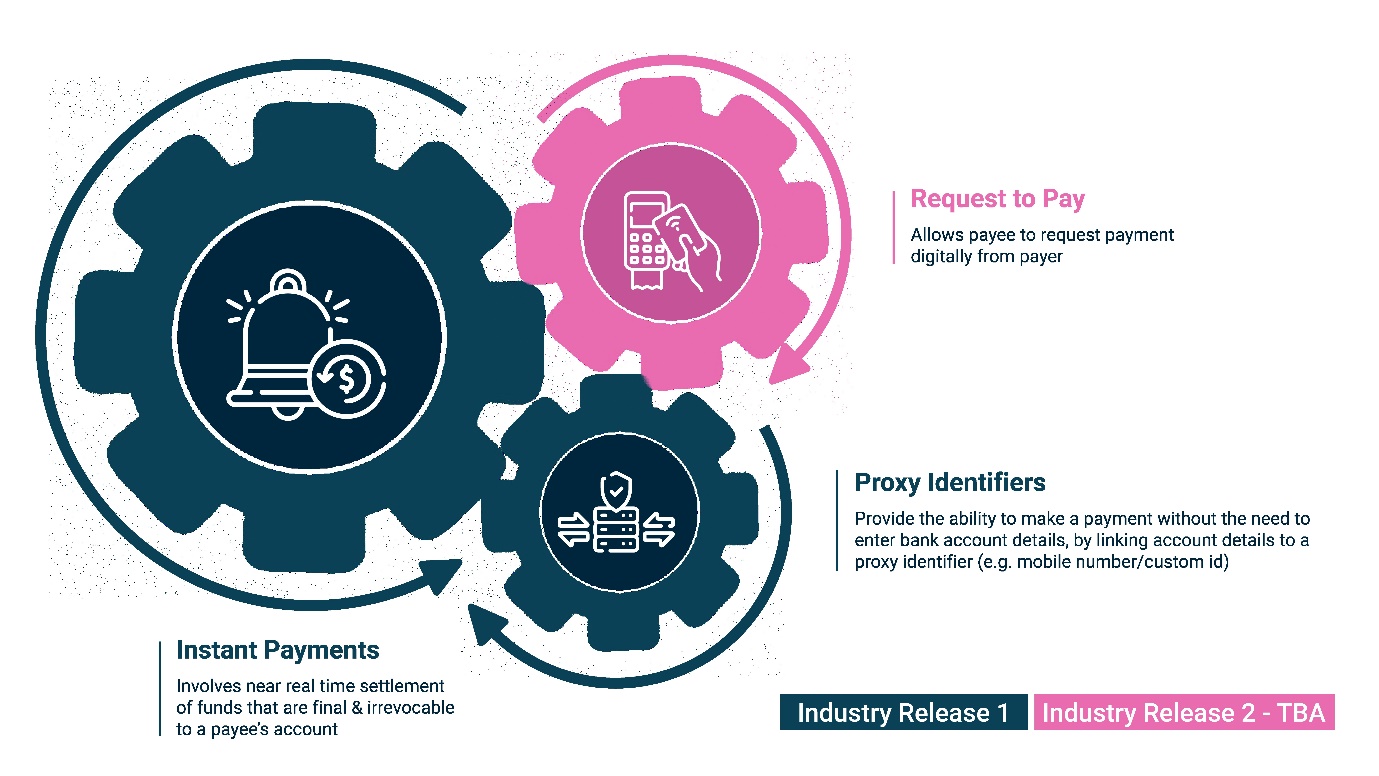

The Payment Industry is laying the foundation for the Payment Modernisation Journey in South Africa, to meet the SARB’s 2025 vision. The vision is to develop payment systems that are transparent, secure, easy to use, financially inclusive and flexible enabling more of the population to enter the digital economy.

The PayShap solution is made up of 3 main components:

The client had decided to participate in the industry initiative to be an early adopter of innovative payment solutions.

Synthesis, in partnership with the bank’s payments product owner and different payment business units, conducted strategy analysis, modeled the business requirements and rules, identified the core systems and business processes that would be impacted through enhancements or new development and crafted a process map that would:

Enable clearing, settlement and reconciliation

Synthesis assisted the bank in delivering and supporting RPP effectively and efficiently by orchestrating business requirements, solution designs, scope and process maps within the bank’s current payment landscape. This enabled the bank to meet the industry standard and deliver an intuitive client experience for the bank’s client base.

Copyright © 2024 Synthesis. All Rights Reserved. Sitemap

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields