Creating Payment Ecosystem Awareness – Moving the Economy from Cash to Digital

Helesha Moodley

- Banking, payments

We have crafted solutions for industry leaders, combining years of expertise with agility and innovation.

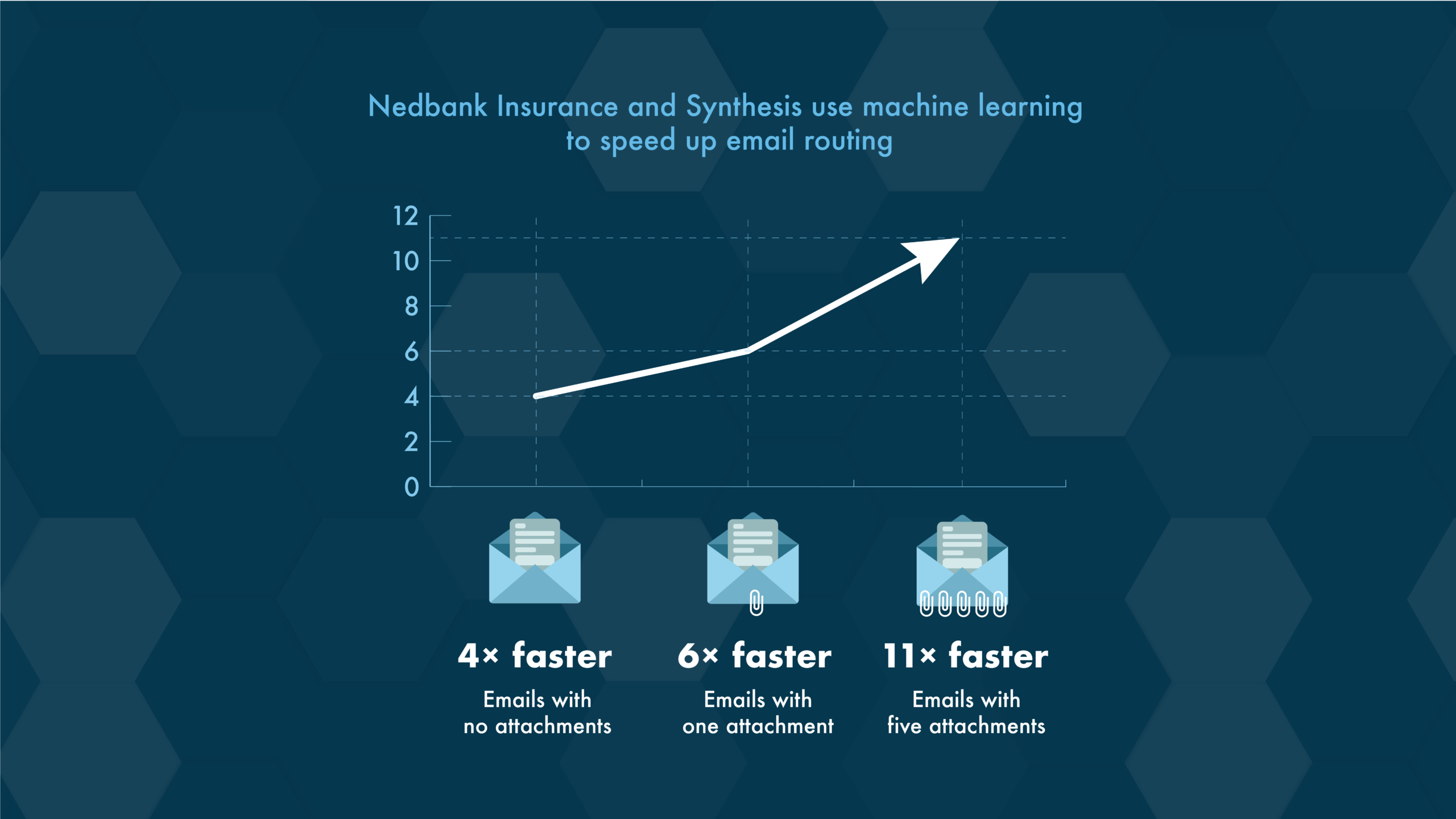

Nedbank Insurance and its service provider Synthesis have used machine learning and design thinking to solve a complex challenge that every business faces: How do you channel a sea of emails so that they land at the right desks? How do you automate email routing? In the past Nedbank Insurance employees spent eight hours a day reading and categorising emails. A robot now does it 24/7 to make sure that clients get a quick response. It’s helped Nedbank Insurance to clear its main client inbox 7,5 times faster, to get rid of the backlog and to speed up client service. And there seems to be great potential for this application to be used across the organisation to drive efficiencies.

Today every business has an email address. And if you’re a financial services organisation with many business sections and over a million clients, that channel can get crowded. Nedbank Insurance covers clients’ life and other insurance needs and receives thousands of emails about claims, policies, address changes, complaints, queries and potential new clients. Some emails are long; others are short. Many have attachments that must be categorised correctly to simplify processing for back-end teams. There are also unpredictable peaks when for example heavy storms cause inboxes to be bombarded.

With this in mind, Indranil Bandyopadhyay, Head of Business IT Enablement for Nedbank Insurance, suspected that an automated system could solve the problem, and increase operational efficiency and client satisfaction. ‘With the old system, a single person can, on average, process one email every 60 to 300 seconds (three minutes on average). That’s about 160 emails per dedicated resource a day. With email volumes growing, our backlogs were mounting, and we didn’t want this to influence our client service. We knew technology could help us create a more sustainable solution, but we needed the right partner,’ says Bandyopadhyay. ‘Nedbank Insurance had to try a couple of times to get this right and with Synthesis we succeeded.’ Synthesis has been around the block. ‘We have significant experience in using emerging technologies to help organisations transform, but we’ve found there’s something more important than technology: Applying design thinking. We try to define an end-to-end system that is practical and includes all supporting processes. The challenge was interesting and we had to work closely with stakeholders and create a plan with the Nedbank tech team,’ says Marais Neethling, Synthesis AI Evangelist.

Following various methods to analyse email and attachment data, Synthesis built predictive machine learning models with natural language processing algorithms to understand the intent of the email. The models first learnt from the employees at a rapid pace, refining the process through feedback. Then, when the models performed reliably in terms of predicting where emails should go, they were routed automatically. ‘What struck me is that Synthesis used design thinking to truly understand what the problem was. In a very short time they created a prototype, tested it with users and then adapted it. The solution they created revolved around genuine client satisfaction and not just completing a task, and that worked for us,’ says Bandyopadhyay.

The new system has significantly reduced email processing time, on average from 720 seconds to 28 seconds. ‘Clients’ experience will change immensely, because now we can work on whatever our clients request immediately. During a peak the machine can handle the volume of requests and now nothing hinders us from responding to client needs. This will greatly improve client experience and will support our commitment to serving clients,’ says Bandyopadhyay. In turn Synthesis thinks Nedbank Insurance deserves recognition for its persistence.

“This is what it takes to pioneer advancements,’ says Neethling. ‘It will be great to support Nedbank Insurance as it continues its transformation journey and client satisfaction drive.’ Nedbank Insurance now wants to leverage the solution across the business. ‘Any electronic interaction is the next step,’ explains Bandyopadhyay. ‘All we need to do when someone calls in is to convert the voice into text – and route the call correctly. Artificial intelligence and machine learning are the ideal way for us to tap into the digital world truly to meet our clients’ needs. We are excited to delve further into the possibilities of this technology.’

Copyright © 2024 Synthesis. All Rights Reserved. Sitemap

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields