Synthesis & Cintra: Your Partners for Oracle on AWS Success in South Africa

Synthesis Staff

- AWS, Cintra, Cloud, oracle

We have crafted solutions for industry leaders, combining years of expertise with agility and innovation.

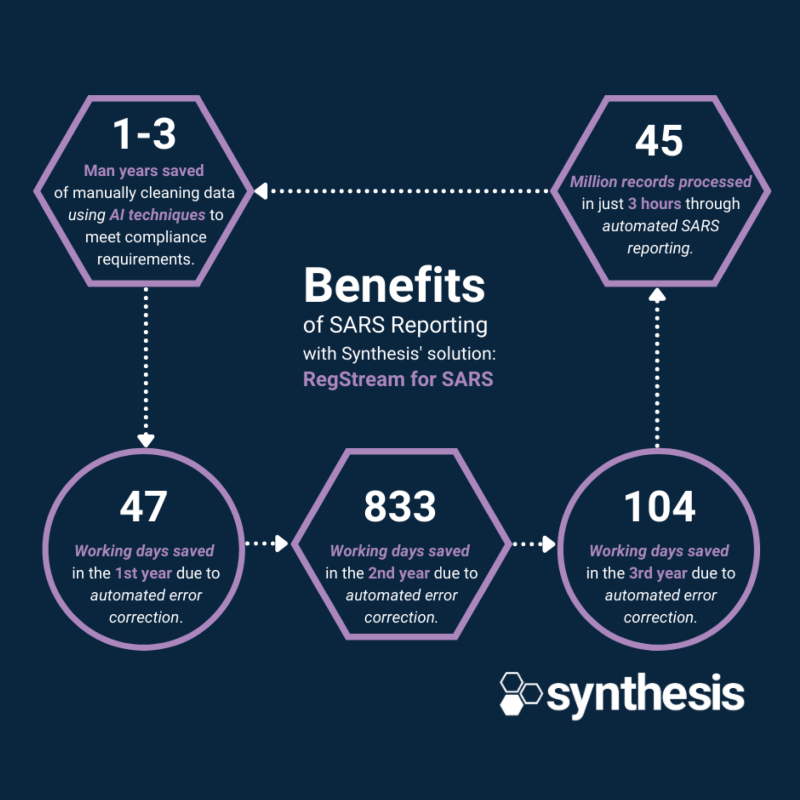

TymeBank implemented a sustainable solution to meeting South African Revenue Services’ (SARS) annual deadlines for IT3(b) and FATCA CRS reporting with the use of the Synthesis txstream SARS suite. The solution automates SARS reporting and will, in future, scale to accommodate TymeBank’s growing customer base.

As a newly launched entity operating in a highly regulated, rapidly evolving environment, TymeBank prioritises compliance. The options available to the bank for SARS submission were either to develop a solution internally or outsource to an external service provider. The decision was made to onboard an external provider due to internal time and resource constraints. TymeBank chose to consult Synthesis. Amina Mula, TymeBank, Tax Manager, explains, “Synthesis was selected due to its experience in providing the required solution to other clients particularly within the banking space and the technical expertise presented. At the beginning of the engagement, the Bank was assured of a dedicated resource to ensure a timeous submission and Synthesis delivered on this”.

Synthesis’ txstream SARS reporting suite met the TymeBank’s requirements and provided the solution needed. The Synthesis txstream for SARS Suite is a recognised regulatory reporting solution that is used in local banking, financial services, treasury and trading environments. The implementation was quick. “We deployed an on-premises instance of the txstream for SARS software within eight weeks – in time to meet the SARS deadline,” notes Luke Machowski, Specialist Product Architect of Synthesis.

The txstream for SARS Suite reaches into the bank’s source systems, collecting and collating the necessary data for reporting. It validates the data against a rules-engine for SARS requirements, then automates submission. In addition, the txstream for SARS Suite is continually updated to meet changing SARS regulations.

Mula notes that “the implementation demanded an understanding of our internal systems, infrastructure, and of our data. Synthesis established relationships with the relevant stakeholders in order to better understand all these requirements. There was a simultaneous focus on future submissions and the requirements or lessons learnt. The support from Synthesis made it as easy as it could be in light of these challenges.”

“Synthesis’ txstream SARS Suite gives TymeBank a seamless solution which will allow them to efficiently meet future deadlines and comply with ongoing changes to the SARS specifications,” notes Machowski. “We are pleased to be able to support TymeBank as it continues to expand its client base.”

Mula concludes, “Synthesis invested the time in understanding our business and developing an appreciation for how we are different to other banks. This led to a better understanding of our data and ultimately a better solution.

There was a constant focus on the future and the areas in which we could improve to make the submission process easier. Their pattern matching solution was a game changer and was subsequently identified as a useful tool for other areas in the business. In summary, TymeBank is pleased to have engaged with a service provider that is vested in our success. We are sure that there will be future opportunities to engage with Synthesis as we continue to develop our business and enhance our product offerings.”

Copyright © 2024 Synthesis. All Rights Reserved. Sitemap

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields