On Tuesday, 30 November, Capital Appreciation (Capprec), a financial technology (“FinTech”) enterprise, announced its financial results for the six months ended 30 September 2021.

Synthesis Software Technologies comprises the Software and Services segment of Capprec. The innovative software development and consulting company delivered a solid set of financial results, bolstered by excellent results in the period.

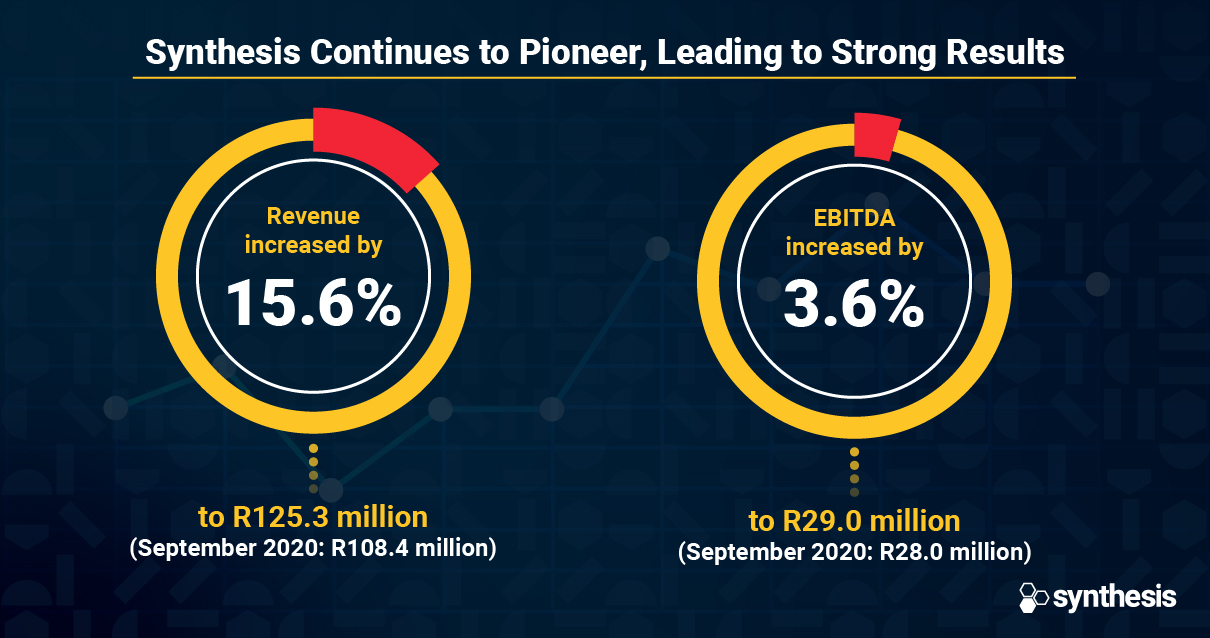

Revenue increased by 15.6% to R125.3 million (September 2020: R108.4 million). Services and consultancy fees grew by 17.4% due to the increased demand for cloud and digital projects, while licence and subscription fees remained stable.

Due to the deliberate investment made into Synthesis’ Payment products (Halo Dot and Keystone) as well as increased sales of third-party partnership software products, which attracts a lower gross margin, profit margins were under pressure. However, Synthesis showed a pleasing result with EBITDA increasing by 3.6% to R29.0 million (September 2020: R28.0 million).

Additionally, new business efforts have opened relationships with 19 new customers since the beginning of the financial year.

“Synthesis is a team of builders. Despite challenging times, we rallied, and inspired, we innovated, always building, creating and solving. We look back at the year with pride, and gratitude to our customers, employees, partners and investors. We look ahead with exhilaration, excited to build on what we have already begun,” says Michael Shapiro, Synthesis Managing Director.

Business Divisions & Partnership Growth

Synthesis experienced a significant increase in its Cloud division in the area of cloud migration projects and attracted further financial services and retail clients.

The AWS partnership continues to grow. Synthesis recently achieved the impressive milestone of 200 Amazon Web Services (AWS) certifications, reflecting the company’s deep technical expertise.

The Digital and Intelligent Data teams recently expanded into the shipping and logistics industry, after winning an RFP to build digital and AI systems for a large container shipping group operating out of Singapore. There is a massive demand for intelligent data solutions and Synthesis has attracted several new customers in financial services, telecoms, retail, healthcare services and contact centres.

Synthesis’ RegTech division continued to grow its range and depth of product for its stable of existing clients and a strong pipeline of potential projects.

In a high growth and exciting area, the Payment Technology and Cryptography division continues to innovate and develop new features for the Halo Dot product. Recent certifications by Visa, Mastercard, and AMEX for PIN entry to enable acceptance of high-value transactions. This makes Halo Dot a complete software alternative to physical POS devices – and a game-changing prospect for the local and global market.

In partnership with DashPay, Synthesis developed a SoftPOS App for Android devices that supports re-branding for customers who want to rapidly deploy their own SoftPOS application.

International Expansion

During the period, the Capital Appreciation Group launched its new subsidiary company Synthesis Labs B.V., driven by Synthesis South Africa and based in the FinTech hub of Amsterdam.

The new venture will allow the Group to capitalise on international opportunities matched to its skillset, services, and product offerings including marketing the Halo Dot offering to banks and global payments providers. It marks the start of a focused effort to further diversify its revenue and customer base by introducing an international client base.

Prospects

With the acceleration in demand for digital transformation, electronic payments, cloud services, and related advances, the strong demand for Synthesis’ services is set to continue into the second half of the financial year.

The themes of cloud migration, emerging technology, and evolving forms of payments are accelerating, and Synthesis is well-positioned to deliver products and value propositions to support its clients’ journeys to becoming more digitally enabled.

Synthesis has a pleasing pipeline of projects lined up for FY 2021. “We will continue to invest for the future in critical resources to grow and deliver our products, solutions and project pipelines,” says Shapiro.

Ends

For more information on the innovative work Synthesis has done for its blue-chip clients, contact:

Kim Furman

Marketing Manager

072 236 3572

About Synthesis

Synthesis is a true South African success story. Synthesis believes that providing innovative solutions based on emerging technologies will help their clients become globally competitive. Synthesis focuses on banking and financial institutions, retail, media and telecommunications sectors in South Africa and other emerging markets.

In 2017 Capital Appreciation Limited, a JSE-listed Fintech company, acquired 100 percent of Synthesis. Following the acquisition, Synthesis remains an independent operating entity within the Capital Appreciation Group providing Cloud, Digital and RegTech services as well as corporate learning solutions through the Synthesis Academy.