Creating Payment Ecosystem Awareness – Moving the Economy from Cash to Digital

Are we still talking about this? Absolutely. Although South Africa has made advances towards moving with innovation and technology, the economy still relies heavily on cash. The concept of cash has always been tangible. It is held, transferred, and weighed, but how many people carry around cash these days? Synthesis Software Technologies, in partnership with […]

Is There A Real Desire To Remove Cash From Circulation? Leading Banks In South Africa Weigh In

Majority of South Africans are still using cash. South African Reserve Bank’s recent report shows that cash is still the most prevalent payment method. On the 10th of October 2024, Synthesis, a leading software development company, invited Financial Institutions and FinTech’s to engage in an insightful discussion on the future of payments for South Africa. […]

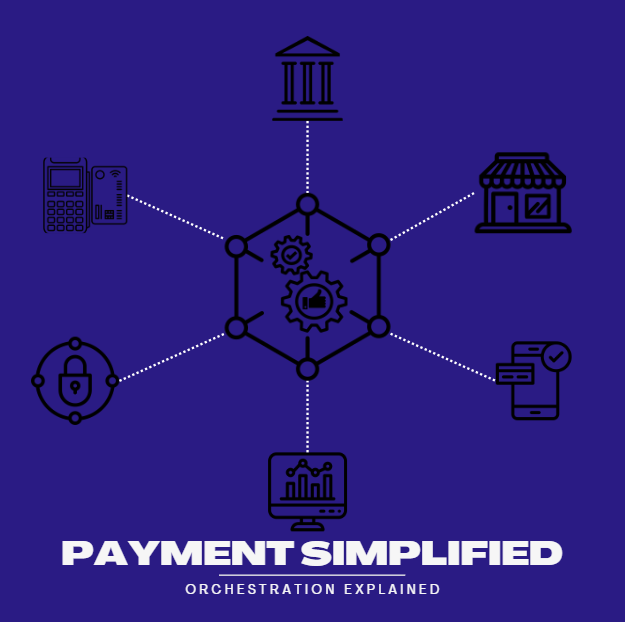

Demystifying Payment Orchestration

In today’s fast-paced digital economy, the payments landscape is undergoing a dramatic transformation. Businesses are increasingly turning to innovative solutions to streamline their payment processes and enhance customer experiences. One of the most transformative strategies gaining traction is payment orchestration. This approach integrates various payment services into a unified platform, optimising efficiency and driving growth. […]

Transforming South Africa’s Payment Landscape

South Africa, a country with rich cultural diversity and varied topography, is undergoing a dynamic transition. The way transactions happen within the country has changed because of the convergence of global standards and technological improvements. In this piece, we examine how ISO 20022, innovative solutions such as DebiCheck and PayShap are bringing South Africans a […]

Enabling client to deliver South Africa’s PayShap payments and to scale up the technology and prepare for the next generation banking.

A leading South African international banking and wealth management group has approached Synthesis to assist them with the building of their next-gen payments platform and enable delivery of PayShap on it.

Geopolitical dynamics reshaping the Cross-Border payment landscape.

The evolving cross-border payment landscape is witnessing noteworthy developments beyond traditional systems. One notable trend is the plan by BRICS countries (Brazil, Russia, India, China, South Africa) to establish their own currency. For over a decade, the BRICS nations have been seeking to reduce their reliance on the US dollar and SWIFT. However, recent geopolitical […]

Revolutionizing Cross-Border Payments: Embracing the ISO 20022 Standard

In the rapidly evolving landscape of cross-border payments, one trend stands out as a game-changer: the migration of SWIFT (Society for Worldwide Interbank Financial Telecommunication) into the ISO 20022 standards. This shift impacts global banks and holds significant potential for transforming the way we conduct international transactions. With the ISO 20022 standard’s data-rich framework, enhanced transparency, […]